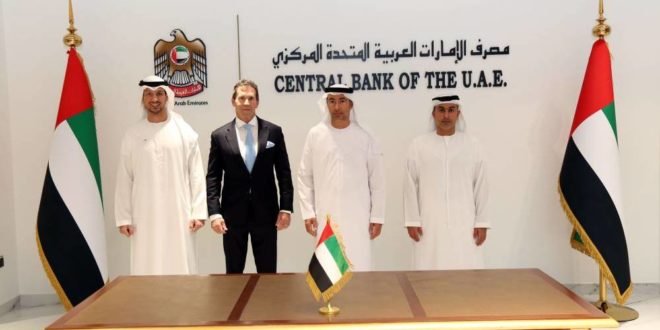

The Central Bank of the Emirates signed an agreement with “G42 Cloud” and “R3” companies to start implementing the Central Bank’s digital currency strategy “Digital Dirham”, one of the nine initiatives of the financial infrastructure transformation program in the UAE. G42 Cloud has been selected to provide infrastructure services for the project, while R3 will provide technology services.

These partnerships come after the success of the digital currency initiatives of central banks, including the “Transient” project with the Central Bank of Saudi Arabia in 2020, the results of which confirmed the possibility of using the digital currency issued by the two central banks to settle cross-border payments. The project also won the “Global Impact 2021” award. Awarded by the Central Banking Journal. In addition to the trial operation of the “Bridge” project for digital currencies of cross-border central banks in cooperation with the Monetary Authority of Hong Kong, the Bank of Thailand, the Digital Currency Institute of the People’s Bank of China and the Bank for International Settlements in 2022, through which financial transactions of real value were completed. These initiatives contributed to the Central Bank’s readiness to implement its digital currency strategy.

The first stage

The first phase of the central bank’s digital currency strategy, which is expected to be completed within the next 12 to 15 months, includes three main pillars: the pilot launch of the bridge platform with the aim of facilitating cross-border digital currency financial transactions and settlement of international trade payments, and bilateral cooperation on proof-of-concept of centralized digital currencies with The Republic of India, which is the largest trading partner of the UAE, in addition to working on proving the concept of a digital currency for central banks to issue a digital currency for the use of individuals, companies and institutions in the UAE.

A central bank-issued and backed CBDC is a risk-free form of digital money and store-of-value with the advantage of being a safer, faster and lower-cost way to make cross-border payments. As part of the efforts to transform the UAE into a digital economy, the central bank’s digital currency will contribute to alleviating the current challenges in local and cross-border payments, achieving financial inclusion and access to a cashless society, and will also contribute to strengthening the payment infrastructure in the UAE and providing additional strong channels for local payments. and international, ensuring a flexible and reliable financial system. In addition, the Central Bank is working on the UAE’s readiness to integrate payment infrastructure with digital coding (tokenisation), which includes coding financial and non-financial activities.

Khaled Mohamed Balama, Governor of the Central Bank, said: “The digital currency initiative of central banks is part of the program to transform the financial infrastructure, which would consolidate the UAE’s leadership position as a global financial center.” He added: “The launch of the Central Bank’s digital currency strategy embodies the development of the money and payments system in the country, as its implementation aims to accelerate the pace of transformation towards the digital economy and enhance financial inclusion. We look forward to seeing the opportunities that the central bank digital currency will bring to our economy and society.”

Media ININ Economy We Trust

Media ININ Economy We Trust