Media In – Dubai – 10 December 2018

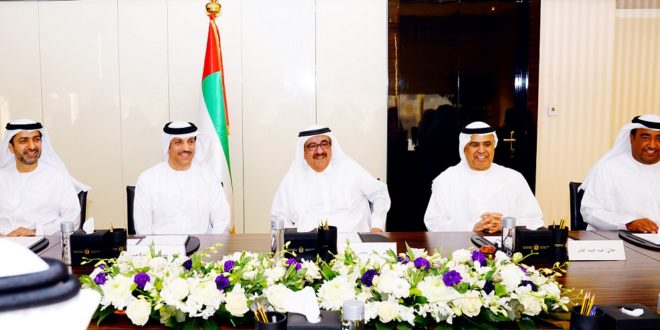

The Board of Directors of the Federal Taxation Authority discussed at its seventh meeting under the chairmanship of His Highness Sheikh Hamdan bin Rashid Al Maktoum, Deputy Ruler of Dubai and Minister of Finance and Chairman of the Board of Directors of the Authority the latest developments in the mechanism of refunding value added tax for visiting foreign businesses in accordance with Federal Law No. 8 of 2017 Value added, conditions, controls and procedures specified in the executive regulations of the decree, which provides for the return of the tax paid for any import or import made by any person who is not a resident of the State or of the applicable State, carries on business and is not subject to tax.

The principle of reciprocity is to be applied through the tax refund mechanism for visiting businesses through cooperation with countries whose value added tax is paid for visiting UAE businesses where reciprocity will be refunded to visiting businesses of the UAE from those countries.

The Council also adopted at the meeting of the Ministry of Finance in Dubai, “the mechanism of the division of input tax related to mixed (ie subject to and exempted)” if the tax is paid for goods or services during a certain tax period to make supplies that allow the right to recover according to the controls Contained in the executive regulations of the Federal Law Decree on Value Added Tax (VAT), which set the criteria for calculating the amount of input tax allowed for recovery, for non-refundable or non-performing activities.

The mechanisms are based on criteria related to output tax, taxable transactions, business space, and segmentation according to number of employees and output tax.

The Board of Directors of the Federal Tax Authority reported on the results of the operation of the first phase of the electronic system to refund VAT for tourists eligible to recover the tax on their purchases as of 18 November last through the airports of Abu Dhabi, Dubai and Sharjah International where the results showed that the system works with great efficiency and high accuracy , And that the tourists who use the system praised the development and speed of completion of transactions in minutes limited and procedures characterized by ease and flexibility.

Media ININ Economy We Trust

Media ININ Economy We Trust