Media IN ABU DHABI, 15th July, 2019 (WAM)

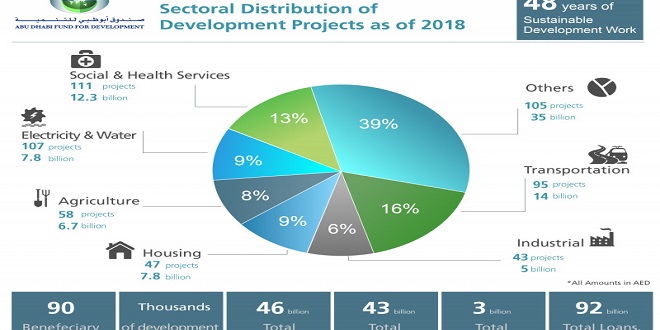

Abu Dhabi Fund for Development, ADFD, the national entity for international development aid, has announced that it has allocated about AED92 billion in development funding and investments to 90 beneficiary countries, the report said while marking its 48th anniversary.

Since its inception on 15th July, 1971, the Fund has disbursed AED43 billion in concessionary loans, AED46 billion in UAE government grants, and AED3 billion in investments.

Along with its core operations, ADFD’s innovative partnerships with the private sector and international funding institutions have helped consolidate the UAE’s prominent status among global foreign aid providers.

The Fund’s support for socio-economic development in developing countries over the past four and a half decades, especially in the last five years, has significantly contributed to the UAE retaining the prestigious title of the world’s top donor of official development assistance relative to national income between 2013 and 2017.

This endorsement was reported by the Development Assistance Committee of the Organisation for Economic Co-operation and Development.

Focusing on key socio-economic sectors, including health, education, housing, water, irrigation, agriculture, and renewable energy, ADFD’s development funding seeks to support the national priorities of beneficiary countries, bolster sustainable economic development, improve standards of living and drive the implementation of the United Nations’ Sustainable Development Goals.

Moreover, ADFD holds equity stakes in numerous companies and private equity funds. Serving various key sectors, these investments play a crucial role in driving economic development and job creation in beneficiary countries.

To date, the Fund has invested in 13 companies and four private equity funds across Africa, Europe, and Asia.

ADFD has also adopted a policy of financing UAE private sector investments. To enhance competitiveness and enable investment opportunities, the policy aims to lay the foundations and guidelines for providing funding for national private sector investments in the UAE and abroad.

In addition, the Fund has amended its tendering system to give 10 percent preference to national companies that pass the technical assessment and financial qualification stage outlined in the Fund’s tender policy for grant projects.

Media ININ Economy We Trust

Media ININ Economy We Trust