Steady increase in card uses outside the country

$55 million withdrawn in a day.. 5 times the average

Instructions to banks to meet the needs of education and treatment abroad

Non-compliance with limits on customer cards in foreign currency

The confidentiality of bank customers’ accounts and transactions shall not be compromised

Cairo:

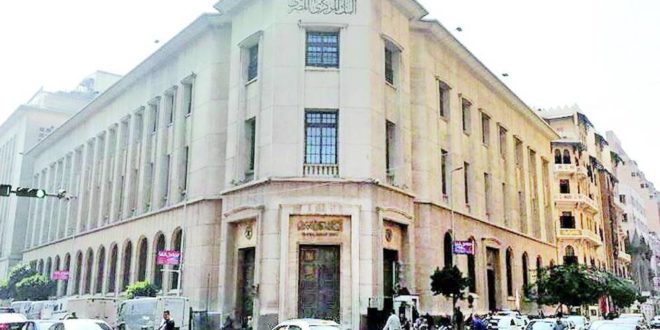

The Central Bank revealed that it monitored a group of illegal practices related to the foreign exchange market, warning that it aims to destabilize the monetary and financial stability of the country in violation of the provisions of the law, and attempts to make quick profits in illegal ways.

The Central Bank said, in a statement on Monday, that these abuses are being tracked and monitored continuously to take the necessary legal measures in their regard.

The bank stated that these practices are summarized in:

The existence of a steady increase in the uses of credit cards and direct debit cards outside the country, despite the presence of customers for whom these cards were issued inside the country, as it reached its peak in the middle of last week, with amounts amounting to $ 55 million in one day, an increase estimated at more than 5 times. than the daily average in the last quarter of the previous year.

He pointed out that this indicates misuse of these cards, and this necessitated taking procedures and controls that prohibit the misuse of credit cards and direct debit cards for customers who have not left the country, as well as provisions for controlling requests for foreign exchange for the purposes of traveling abroad.

He said that the necessary measures will be taken, in coordination with the concerned authorities, to verify whether the customer has traveled or not, and in the event that the customer has not traveled or misused the cards, dealing on the card will be stopped, and the Egyptian Credit Bureau will be informed, as well as the concerned authorities, to take all possible measures. necessary procedures in this regard.

The Central Bank confirmed that it had issued strict instructions to banks to take into account the setting of sufficient limits to meet the actual needs of customers in foreign exchange, especially for the purposes of education and treatment through cards, while maintaining the previous limits for customers located abroad before the issuance of the new controls on December 22, 2022, as well as not Adhere to any limits on the cards of customers who have accounts in foreign currency and whose uses are paid in the same currency.

The Central Bank of Egypt monitored the trading of commodities inside Egypt in foreign currencies, in addition to monitoring violations in money transfers from Egyptians residing abroad, through illegal channels who are not authorized to carry out these transfers, in violation of the text of Article 212 of the Central Bank and Banking System Law issued By Law No. 194 of 2020.

And he warned that this violation is punishable by imprisonment for a period of no less than three years and not more than ten years, and a fine of no less than one million pounds and no more than five million pounds, or the amount of money subject of the crime, whichever is greater, for everyone who deals in foreign exchange outside banks. approved or licensed entities, or practiced money transfer activity without obtaining a license in accordance with the provisions of Article (209) of this law.

The Central Bank added that some are establishing companies of a special nature outside the country that carry out mediation, especially in the fields of export and tourism, and aim to keep foreign exchange outside the country and deal with it outside the legal framework. In addition, some of these companies request the procurement of foreign exchange from the Egyptian banking sector, despite the fact that they maintain accumulated foreign exchange earnings abroad. In the event that this is proven, all prescribed measures will be taken against these companies and their shareholders.

The bank confirmed that the banking system has played an effective role in releasing goods in ports worth about $5 billion since the beginning of this month, to meet the needs of the market.

The Central Bank of Egypt stressed that there is no prejudice to the confidentiality of bank customers’ accounts in Egypt, for which the Central Bank and Banking System Law has set strict guarantees to protect them, as it guaranteed the protection of the confidentiality of banking sector customers’ data, accounts, deposits, trusts, and safes in banks, as well as the confidentiality of related transactions, as stipulated in the law. However, it is not permissible to view it, or to give data about it to any party, directly or indirectly, except with the written permission of the owner of the account, deposit, trust, or treasury, or from one of his heirs, or from one of the legatees for all these funds or Some of them, or from his legal representative or agent, or based on a judicial ruling, or an arbitral award.

The Central Bank affirmed that it closely monitors developments in the foreign exchange market, and that it takes all necessary measures to confront any practices harmful to the national economy, as well as taking all necessary measures to control the market and stabilize monetary conditions in the near future.

The bank called on the Egyptian citizens to be careful and not to fall behind any practices aimed at making quick profits through illegal means. In order to preserve their money and to avoid falling under the law.

The Central Bank stressed the strength and solidity of the banking sector and its ability to withstand all shocks, in order to ensure the preservation of deposits of bank customers in various currencies.

Media ININ Economy We Trust

Media ININ Economy We Trust